Filed under: The World

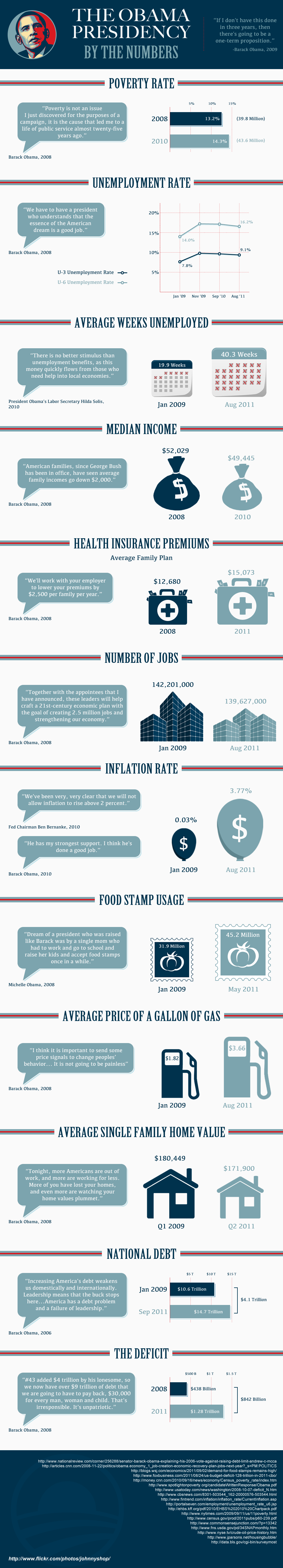

Presented with no comment.

I feel a tremendous responsibility to write this article though I am a little apprehensive. Thinking about the possibility of rising up against our own government is a frightening thing for many of us. I am not Johnny Rambo and I will be the first to admit that I do not want to die. The reason I feel compelled to write this, however, is simply because I don’t think the average American is equipped with the facts. I feel that a lot of American citizens feel like they have no choice but to surrender their guns if the government comes for them. I blame traditional media sources for this mass brainwash and I carry the responsibility of all small independent bloggers to tell the truth. So my focus today is to lay out your constitutional rights as an American, and let you decide what to do with those rights.

I feel a tremendous responsibility to write this article though I am a little apprehensive. Thinking about the possibility of rising up against our own government is a frightening thing for many of us. I am not Johnny Rambo and I will be the first to admit that I do not want to die. The reason I feel compelled to write this, however, is simply because I don’t think the average American is equipped with the facts. I feel that a lot of American citizens feel like they have no choice but to surrender their guns if the government comes for them. I blame traditional media sources for this mass brainwash and I carry the responsibility of all small independent bloggers to tell the truth. So my focus today is to lay out your constitutional rights as an American, and let you decide what to do with those rights.

View original post 2,289 more words

Filed under: Local Networks, The World | Tags: Alan Greenspan, Ben Bernanke, Chris Duane, Federal Reserve, Federal Reserve System, Fiat money, Hyperinflation, iPhone, Purchasing power, United States

When the mathematically certain collapse of the US Dollar happens, the majority of Americans will be caught off guard, and they will have no idea what led to the demise of the world’s reserve currency. Some will know that the stock market crashed as investor’s greed morphed violently into fear. It will be all over the news. Most will get to witness the bank runs and looting live on their iPhone. It will go viral within minutes, and the tweets will herald the crisis with each down tick of the market. All that live will see the results. Few will know how things got so bad.

When the mathematically certain collapse of the US Dollar happens, the majority of Americans will be caught off guard, and they will have no idea what led to the demise of the world’s reserve currency. Some will know that the stock market crashed as investor’s greed morphed violently into fear. It will be all over the news. Most will get to witness the bank runs and looting live on their iPhone. It will go viral within minutes, and the tweets will herald the crisis with each down tick of the market. All that live will see the results. Few will know how things got so bad.

In the not too distant future

Great question. Let us begin with the root of the problem. What we have called money for the last hundred years or so, was actually not money at all. It was fiat currency. In order for something to be money, it needs to fulfill the following criteria:

- It must be a medium of exchange.

- It must be a unit of account.

- It must be a store of value.

The fiat currency that was used right up until the moment it was worthless, was not money. Once, when it was backed by gold and coins were made of silver, it could have been considered a store of value, but in the end it was not worth the paper it was printed on. Besides, an overwhelming majority of the dollars that existed were nothing more than 1’s and 0’s in cyberspace. Again, backed by nothing. When the music stopped, there just weren’t that many chairs left to sit in. I say this because it wasn’t just the cash.

All paper assets were backed by the dollar, and every one of them had counter party risk. Which is to say, they were all dependent on someone else to back up their value. The entire future of our society was lost to counter party risk. IRA’s, 401(k)’s, mutual funds, ETF’s, bonds, pension plans, and bank accounts were all reduced to memory with a few keystrokes. Each of them were backed by the full faith and credit of the government. Each of them rendered worthless by the Federal Reserve’s “Print your debt away” monetary policy.

They attempted to keep the government afloat by purchasing bonds with money created out of thin air. Yes, at that time, the Federal Reserve was not only allowed to just print money, but they insisted that was the only way to save the economy. The chairman of the Fed, Ben Bernanke, told Congress that it was none of their business who he made loans to. They printed so much money that the dollar lost more than 90% of its value in less than 100 years

They attempted to keep the government afloat by purchasing bonds with money created out of thin air. Yes, at that time, the Federal Reserve was not only allowed to just print money, but they insisted that was the only way to save the economy. The chairman of the Fed, Ben Bernanke, told Congress that it was none of their business who he made loans to. They printed so much money that the dollar lost more than 90% of its value in less than 100 years

For years, people complained about rising prices and stagnant wages. While the wages were stagnant, the loss of purchasing power of the dollar was the real criminal, not rising prices. When he was the chairman of the Federal Reserve, Alan Greenspan told Congress that the Federal Reserve could print all the money that was needed, but they could not guarantee purchasing power. Whether we weren’t listening, or didn’t know how to fix it, is debatable. They warned us before the last blow was struck. Not enough people responded.

Once upon a time, when I was growing up, we believed that if a person had enough money in the bank, that person could live on the interest generated by that money. It was a goal that the average American believed in. Year after year, the Federal Reserve manipulated the numbers to keep the illusion of low inflation, while all along, the purchasing power of the dollars in the bank continued to shrink. Towards the end, the high inflation turned phantom interest rates into real negative growth. Savers were punished with the loss of their capital. The indoctrination of 99% of the population began at birth. It was a lie.

Only those who were aware enough to seek future answers in their past were able to make the choices in the new paradigm. It was those sage men and women who learned from the repeating cycles that shaped America since her birth. We became so fascinated with our digital lives, that we lost our ability to take care of our physical selves. Those that saw the writing on the wall began to act with a new sense of urgency. They retrained themselves to think and to learn differently. They rejected the input and output system that they were born into. In its place, they chose the disciplines of grammar, logic. and rhetoric to teach the next generation. A generation born free, never knowing the pain of debt.

Filed under: Silver, The World | Tags: Bill of credit, Chris Duane, collapse, Contract Clause, currency, debt, Ex post facto law, Federal Reserve Note, fiat, Hyperinflation, investing, Letter of marque, money, Prepping, Silver, Silver coin, Title of Nobility Clause, United States

I recently asked Chris Duane this question: What is a realistic amount of silver to have to make sure one’s place in the new paradigm? Chris, if you do not already know, is the sage voice behind the Silver Bullet Silver Shield program. His case for the value of silver, as well as his sound logic and theory of the coming mathematically certain collapse of the US Dollar, is what led me to start preparing my family for the paper firestorm on the horizon. His answer was not what I expected.

Here is what he said:

“1,000 Mercury Dimes will cost about $2,500 and represents 1,000 days of hard human labor throughout all of history and 2/3rds of the world that does not have access to the debt and oil that we currently have. After that is gravy.”

That, in my opinion, is a realistic number that even the most cash strapped house can afford. Allow me give an example. How many people do you know that begin each day with at trip to the local corporate coffee emporium? To sacrifice one double Grande soy caramel mocha would free up about $5.00 per day, 5 days a week for a total of $25 dollars. At $2.50 for one 90% silver mercury dime it would take a little less than 2 years to have the 1,000 dimes that Chris spoke of. How many of those same people have more than one coffee per day?

That, in my opinion, is a realistic number that even the most cash strapped house can afford. Allow me give an example. How many people do you know that begin each day with at trip to the local corporate coffee emporium? To sacrifice one double Grande soy caramel mocha would free up about $5.00 per day, 5 days a week for a total of $25 dollars. At $2.50 for one 90% silver mercury dime it would take a little less than 2 years to have the 1,000 dimes that Chris spoke of. How many of those same people have more than one coffee per day?

For those of you that are first time readers, I ask you this question: If I gave you $2500 in cash or I gave you 1000 silver mercury dimes and told you that you had to choose one to bury for the next 20 years, which one would you choose? Forget stocks, bonds, IRA’s, dividends, yields, rates of return, or anything about inflation. Which one would survive the physical burial process? If I offered you the same $2500 to deposit in your bank account, would your answer still be the same?

You cannot turn the power off on a bag of silver dimes. Silver has no servers to reset, stacks of coins cannot be vaporized like segregated accounts, and you certainly cannot print more when the government decides to spend itself into oblivion. We have come so far from when the framers of the constitution told us what money was. They were very clear. Here is an excerpt from Article I Section 10:

No State shall enter into any Treaty, Alliance, or Confederation; grant Letters of Marque and Reprisal; coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts; pass any Bill of Attainder, ex post facto Law, or Law impairing the Obligation of Contracts, or grant any Title of Nobility.

Where along the way were we convinced that anything else would suffice? Oh yes, The pesky Federal Reserve Act of 1913. I remember now. It is clear to me that no Federal Reserve note will ever hold value in the future. Very soon, you will not be able to exchange Federal Reserve notes for silver at any price. Those who hold the physical silver, and understand what is looming on the horizon, will simply not part with it. The time to act has never been more opportune or more critical. Once enough people are made aware, there will be a run on silver, and gold, like no one has ever seen.

With more than $190 trillion in global debt, and unfathomable amounts of toxic derivatives backing insolvent banks and nations, all of the worlds wealth will not be able to flow into the metals. There is not enough supply left on the planet to support demand we will be witness to. Put down your coffee, and grasp the opportunity to protect your family from this nightmare.

Filed under: The World

In case you were wondering how we got to where we are.

You keep seeing me say:

“A dime a day will END the charade.”

But what does that mean? After you watch the following video by Chris Duane from his silver bullet silver shield series, continue to read what I have to say on the subject. (you can see the entire playlist here.)

Now that you have spent some time with the background, here we go:

For less than $2.50, you can purchase that mercury dime Chris spoke of from your local coin shop. Tax free, by the way. With the world’s annual mining production at around 700million ounces, and the population of the US at close to 350million, a dime a day for a month, which is a total of just over 2 ounces of physical silver, would soak up the majority of above ground physical silver. This would kill JP Morgan’s strangle hold on the metals market. Forget the “cause” of doing it to slay the demon of the banking industry. Think about your family’s future for a minute.

Remember from the video; each dime represents 12 hours of physical labor for the last 2000 years and 2/3 of the world today. That dime a day will protect you and your family when the mathematically certain end comes to the paper scam that is our economy. Not all will agree with me, but those who are listening, not just scanning my rantings for buzzwords, will see that our time to prepare is almost at an end.

I cannot urge strongly enough that you take your future in your own hands. End the control that the banks have placed on you. Stand up and let the chains of debt bondage fall from you. We can change the paradigm together. Benjamin Franklin once said:

“Yes, we must indeed all hang together, or most assuredly we shall all hang separately.”

Thanks for the reminder Ben.